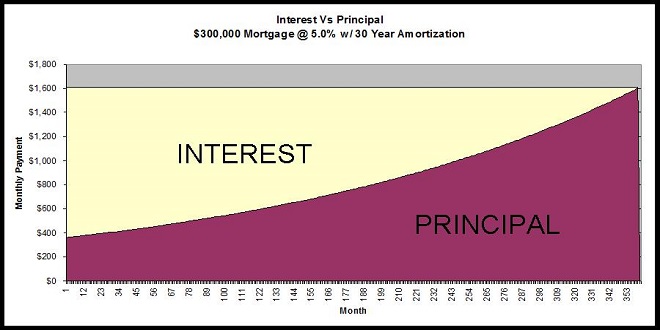

Interest Payments Vs. Principal Payments

Here’s what you need to know about principal payments versus interest payments and how to figure out how much you should be paying toward your principal balance to pay off your debt as quickly as possible. Understanding the concept of interest and principal payments it’s vital first to understand.

What is Interest payment?

The interest payment is a payment made for borrowing money or buying a product on credit in which part of your loan or purchase price you pay as interest. You can usually calculate Interest payments as an annual percentage rate (APR) based on your amount owed and how long it takes to pay off that debt, also known as a loan’s maturity date.

What is Principal Payment?

When you take out a loan, part of what you’re paying for (other than interest) is to pay off your balance. The principal payment is that balance – it’s what you have leftover to pay on top of your interest payment at any given time.

Interest Payments Vs. Principal Payments

When you take out a loan, you typically make monthly payments on that loan until it’s paid off in full. Part of these payments goes toward the interest you owe each month, and part goes toward paying down the principal or what you originally borrowed. Interest payments are like an ongoing tax on your debt; principal payments are like paying off the taxes on that debt to pay it off ultimately.

Paying down your credit card balance faster means you’ll pay less interest. And according to SoFi monthly credit card interest calculator, paying down your balance faster can result in a higher score. So, for example, suppose you don’t use your credit card enough to earn rewards.

In that case, it’s usually better to carry an outstanding balance that accrues interest rather than pay off your card in full each month because of the high-interest charges you might otherwise face. In other words, interest payments are mandatory and guaranteed by the lender in these situations. However, you can pay more than the minimum amount required toward your principal balance if you choose to do so.

How Do You Know if You Are Paying Off Your Principal Or Interest Payments First?

You can quickly tell if you are paying off your principal or interest by looking at your statement and noticing which payments fit under principal or interest. However, you can also divide your payments into interest and principal buckets based on how much money you owe. Also, a monthly credit card interest calculator will help you keep track of whether or not you are making progress on paying off your debt.

You should always pay off your credit card bill in full every month because you don’t want to pay interest on your purchases. However, it’s sometimes good to tackle your balances from the highest interest rate to the lowest.